Brexit's Effect on New York's Ascent as a Main Monetary Center

A new review by Duff and Phelps shows that New York has surpassed London as the main worldwide monetary focus, basically because of the repercussions of Brexit. The yearly Worldwide Administrative Standpoint study included reactions from 180 chiefs across different areas, for example, resource the executives, multifaceted investments, confidential value, banking, and business.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

Members were approached to communicate their perspectives on what is an optimal monetary focus, with choices including the US, England, Ireland, Hong Kong, Singapore, and Luxembourg. North of 60% recognized New York as the top worldwide monetary center, a striking ascent from 2018 when just 10% favored it, while London's allure decreased to 17 percent from the earlier year.

Moreover, Duff and Phelps saw that 12% of respondents predict Hong Kong arising as the superior monetary focus inside the following five years, featuring a worldwide change in monetary needs.

In light of Brexit, the English government has communicated idealism about the strength of the UK monetary area. In any case, Dublin, Luxembourg, and Frankfurt have additionally seen development this year as the European Association's monetary industry looks for elective center points, as per the review.

With England's partition from the EU having confronted two postponements and another cutoff time moving toward on October 31, vulnerability perseveres in regards to future exchange relations and the capacity of resource administrators, banks, and guarantors to lay out joins with clients inside the EU market.

latest_posts

- 1

'Dancing with the Stars' semifinals: How to watch Episode 10 tonight, where to stream, who's left and more

'Dancing with the Stars' semifinals: How to watch Episode 10 tonight, where to stream, who's left and more - 2

Hubble sees spiral galaxy in Lion's heart | Space photo of the day for Nov. 4

Hubble sees spiral galaxy in Lion's heart | Space photo of the day for Nov. 4 - 3

Putting resources into Yourself: Self-awareness Techniques

Putting resources into Yourself: Self-awareness Techniques - 4

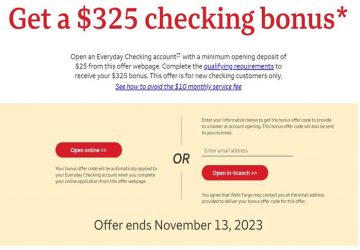

Figure out How to Score Huge with Open Record Rewards

Figure out How to Score Huge with Open Record Rewards - 5

Top notch Remote Earphones for Audiophiles

Top notch Remote Earphones for Audiophiles

share_this_article

The Magnificence of Do-It-Yourself Skincare: Regular Recipes and Tips

The Magnificence of Do-It-Yourself Skincare: Regular Recipes and Tips Vote In favor of Your Number one Sort Of Blossoms

Vote In favor of Your Number one Sort Of Blossoms This Week In Space podcast: Episode 189 — Privatizing Orbit

This Week In Space podcast: Episode 189 — Privatizing Orbit Top Pastry: What's Your Sweet Treat of Decision?

Top Pastry: What's Your Sweet Treat of Decision? Comet C/2025 K1 (ATLAS) breaks apart in incredible telescope photos

Comet C/2025 K1 (ATLAS) breaks apart in incredible telescope photos Jasmine Crockett in, Colin Allred out: A major shakeup for Democrats in their quest to finally win a Senate seat in Texas

Jasmine Crockett in, Colin Allred out: A major shakeup for Democrats in their quest to finally win a Senate seat in Texas Which Film Has the Incomparable Melodic Score?

Which Film Has the Incomparable Melodic Score? 4 Sound blocking Earphones for Prevalent Sound and Solace

4 Sound blocking Earphones for Prevalent Sound and Solace 'Sex and the City' star Kim Cattrall marries longtime partner Russell Thomas in intimate London wedding

'Sex and the City' star Kim Cattrall marries longtime partner Russell Thomas in intimate London wedding